Governor Mills’ two-year budget proposal adds over $187 million in prospective funding for education from early childhood through college, including $126 million for K-12 schools.

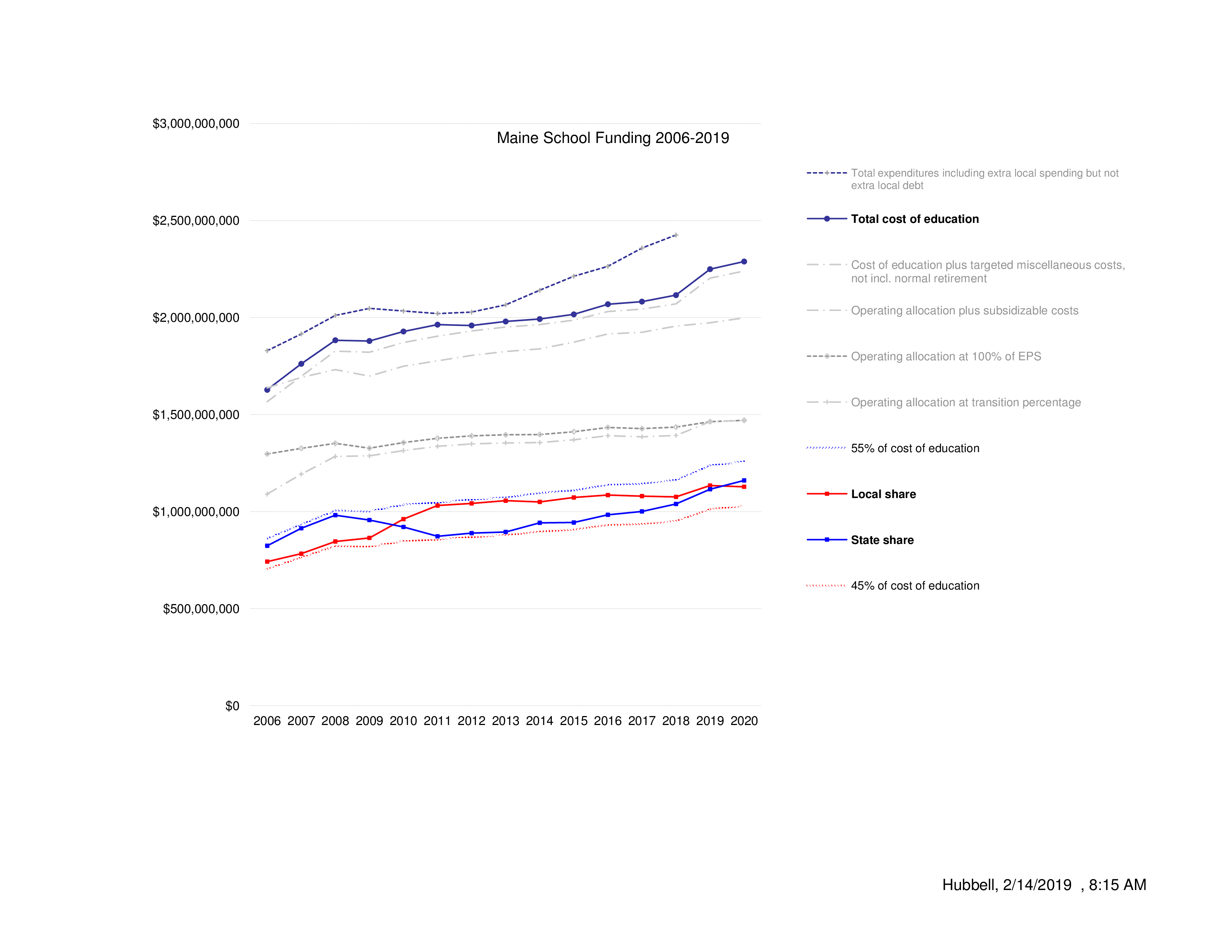

The top lines of graph above show the cost of education over the past ten years in terms of both total expenditures and also the state’s calculation of the cost of Essential Programs and Services.

The bounded red and blue lines below indicate the value of the state subsidy (blue) and the mandated local share from property tax (red) which sum to the value of the Essential Programs and Services line above.

The blue dotted line tracks the state subsidy target of 55% of EPS while the red dotted line tracks the complementary 45% target for the local share.

For the first few years of the EPS model, from 2006 through 2008, the state subsidy did track the 55% spending target.

The 2008 recession prompted spending curtailments which, by 2011, reversed the spending targets to the point where state subsidy was only 45% of EPS and local property taxes supported 55% of EPS.

From 2011 until the current 2018-2019 biennial budget, increases in state subsidy barely paralleled increases in the cost of Essential Programs and Services.

In the current year, an large increase in state subsidy was overshadowed by an even larger $135 million increase in the cost of education. As a result, while state subsidy increased, property taxes did as well.

In the current budget proposal, for the first time, since 2008, the value of state subsidy at 50.7% of EPS is greater than the complementary required local share of 49.3%.

For FY 2020, the budget proposes a $45 million increase state subsidy. This, applied against a $39 million increase in the total EPS allocation for education, nets a $6 million decrease in the required local share.

While increases in education allocation over the past two years have been good for schools, this finally also combines good news for property tax payers.